What Happens If You Miss the Due Date for Filing ITR?

Timely filing of Income Tax Returns (ITR) is important for every taxpayer in India. Missing the prescribed due date not only attracts penalties but can also restrict certain benefits available under the Income Tax Act. Let’s look at the possible outcomes if the ITR is not filed within the deadline. Filing a Belated Return If […]

Tax Compliance Checklist for Start-ups in 2025

Starting a new business in India comes with exciting opportunities, but also with a range of tax compliance obligations. Start-ups must navigate both direct and indirect taxes to remain compliant and avoid penalties. Staying on top of tax deadlines and requirements is essential for financial stability and long-term growth. This guide provides a detailed tax [...]

Set-Off and Carry Forward of Losses under the Income Tax Act

The Income Tax Act, 1961 provides a systematic framework for adjusting losses against income, ensuring that taxpayers are not taxed unfairly when their earnings fluctuate. These provisions, known as set-off and carry forward of losses, allow taxpayers to balance losses in one year with profits in the same or subsequent years. A proper understanding of [...]

How to File Income Tax Return After the Due Date

Filing your Income Tax Return (ITR) on time is crucial to avoid penalties, interest, and other consequences. However, taxpayers may sometimes miss the deadline due to incomplete documentation, oversight, or delayed tax planning. The Income Tax Act allows taxpayers to file a belated return in such cases, offering relief while ensuring compliance. This article explains [...]

GST Registration for Foreign Companies in India

India’s Goods and Services Tax (GST) has unified the indirect tax framework across the country. While Indian businesses are required to register once they cross the prescribed turnover threshold, the rules are more stringent for foreign companies. Any overseas entity supplying goods or services in India must obtain GST registration as a Non-Resident Taxable Person [...]

GST Old vs New Rates: Key Differences under GST 2.0

When the Goods and Services Tax (GST) was implemented in 2017, it replaced a complicated network of central and state levies with a unified indirect tax system. While this reform was transformative, over time, the system became burdened with multiple slabs, inverted duty structures, and procedural delays, leading to inefficiencies for both businesses and consumers. [...]

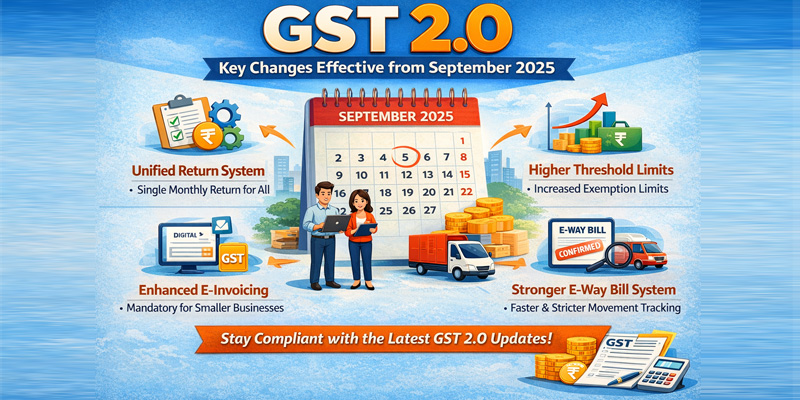

GST 2.0: Key Changes Effective from September 2025

The rollout of GST 2.0 in September 2025 represents a defining moment in India’s indirect taxation framework. This reform aims to simplify tax structures, rationalize rates, and resolve long-standing inefficiencies, with a strong focus on youth-driven sectors of the economy. By reducing the tax burden across industries such as education, healthcare, technology, textiles, food processing, [...]

GST 2.0: Impact on Small Businesses and MSMEs

The introduction of GST 2.0 in September 2025 marks a significant step forward in India’s indirect tax landscape. While the original GST framework launched in 2017 unified the tax system, it also brought with it multiple tax slabs, inverted duty structures, and a heavy compliance burden that proved particularly challenging for small businesses and MSMEs. [...]

GST 2.0: A New Era of Indirect Tax Reform in India

The launch of GST 2.0 in September 2025 marks a significant milestone in India’s taxation system. Since the introduction of the Goods and Services Tax (GST) in 2017, the aim has been to unify multiple indirect taxes under a single umbrella. While GST simplified the earlier tax regime, practical challenges such as multiple slabs, inverted [...]

E-Invoicing under GST – Latest Updates (2025)

E-Invoicing under GST is a system that allows businesses to generate a unique Invoice Reference Number (IRN) through the Invoice Registration Portal (IRP) for their B2B invoices, debit notes, and credit notes. This mechanism ensures real-time reporting of transactions, reduces tax evasion, and enhances transparency across the GST ecosystem. In 2025, the government has introduced [...]